Don’t Assume Your Insurance Covers Your Meds

Every year, thousands of people walk into a pharmacy with a prescription in hand, only to be told their insurance won’t cover it-or the copay is $800 instead of the $20 they expected. This isn’t a rare mistake. In 2022, 63% of people shopping for health plans on the Marketplace didn’t check if their specific medications were covered until after they enrolled. By then, it was too late. The result? Nearly 3 out of 10 switched plans the next year because they got stuck with bills they never saw coming.

If you take any regular prescription-whether it’s insulin, blood pressure pills, or a specialty drug for a chronic condition-your insurance formulary matters more than your monthly premium. A plan with a $300 premium might actually cost you more than one at $600 if your meds aren’t covered or have sky-high copays. Here’s what you need to ask before you sign up.

Is My Exact Medication on the Formulary?

Every insurance plan has a list of drugs it covers called a formulary. It’s not a suggestion. It’s a rule. If your drug isn’t on the list, you’ll pay full price. And no, your doctor’s recommendation doesn’t override it.

Some plans cover generic versions only. Others cover brand-name drugs but only after you’ve tried cheaper alternatives first (this is called step therapy). Some don’t cover specialty drugs at all-or only if you jump through hoops like prior authorization.

Don’t just ask, “Do you cover metformin?” Say: “Is metformin ER 500mg covered under Tier 1? Is there a preferred brand? Is prior authorization required?” Write down the exact name, strength, and dosage. Even small differences (like immediate-release vs. extended-release) can change coverage.

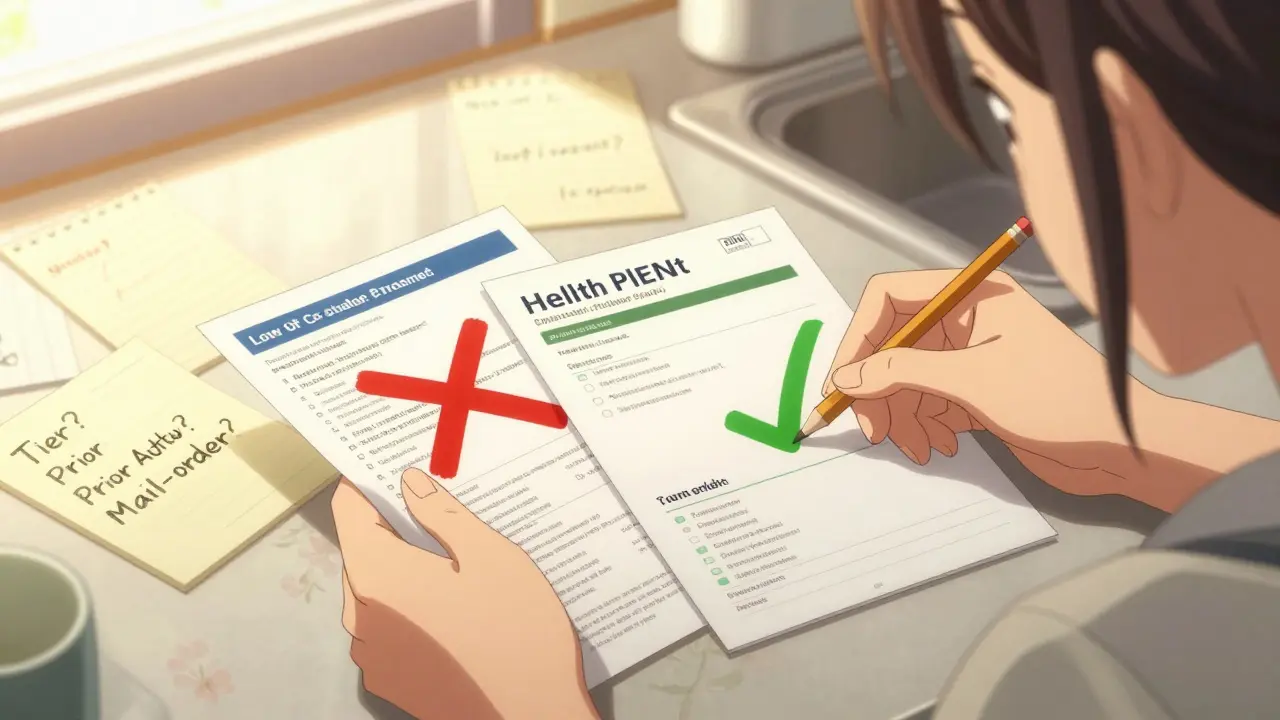

What Tier Is My Drug On?

Most plans group drugs into four tiers. Each tier has a different cost. Here’s what you’re likely to see in 2025:

- Tier 1: Generic drugs - Usually $10-$15 copay

- Tier 2: Preferred brand-name drugs - Around $40-$50 copay

- Tier 3: Non-preferred brand-name drugs - $80-$120 copay

- Tier 4: Specialty drugs - 25-33% coinsurance. Could be $500-$2,000 per prescription

Insulin, for example, might be on Tier 2 in one plan and Tier 4 in another. That’s a $35 vs. $1,200 difference. Always ask: “What tier is my drug on?” Then ask: “Is there a cheaper alternative on a lower tier?” Sometimes switching to a different version of the same drug saves hundreds.

What’s My Out-of-Pocket Cost Before Coverage Starts?

Many plans have a deductible-meaning you pay 100% of drug costs until you hit a certain amount. Bronze plans often have $6,000 deductibles. That means if you need a $1,000 monthly specialty drug, you pay it all for months.

Ask: “Does my plan have a drug deductible? If so, how much?” And: “Does the deductible apply to all drugs or just certain tiers?” Some plans waive the deductible for Tier 1 and 2 drugs but not for specialty meds.

For people taking multiple prescriptions, a $150 deductible on a Gold plan might be better than a $6,000 deductible on a Bronze plan-even if the premium is $200 higher. Calculate your annual drug cost. Then compare total out-of-pocket across plans. The cheapest premium isn’t always the cheapest overall.

Are There Pharmacy Network Restrictions?

Even if your drug is covered, you might not be able to get it where you want. About 78% of Marketplace plans limit you to a specific network of pharmacies. If you use an out-of-network pharmacy, your copay could be 37% higher-or you might get denied entirely.

Ask: “Which pharmacies are in-network?” Then check your usual pharmacy. If you use CVS, Walgreens, or a local pharmacy, make sure they’re listed. If you get mail-order prescriptions, ask if that’s allowed and if it’s cheaper. Some plans give you a discount if you use mail-order for maintenance drugs like cholesterol or diabetes meds.

Do I Need Prior Authorization for My Meds?

Prior authorization means your doctor has to prove to the insurer that you need the drug before they’ll pay for it. It’s common for specialty drugs, high-cost brands, or drugs with cheaper alternatives.

Ask: “Does my medication require prior authorization?” Then ask: “What’s the process? How long does it take?” Some approvals take days. Others take weeks. If you’re starting a new treatment, delays can be dangerous.

One woman in Oregon had to wait six weeks for approval on her MS medication. She ran out and had to buy a month’s supply out-of-pocket-$1,400. If she’d asked upfront, she could have planned ahead or switched to a plan with fewer restrictions.

Is Step Therapy Required?

Step therapy means you have to try and fail on cheaper drugs before the insurer will cover the one your doctor prescribed. It’s used for 37% of specialty drugs in Marketplace plans.

Ask: “Do I have to try another drug first?” If your doctor says the alternative won’t work for you (say, because of side effects or past failures), ask if the plan has an exception process. Many do-but you have to request it. Don’t assume your doctor’s note is enough. Submit the paperwork yourself.

What’s the Coverage Gap (Donut Hole) for Medicare Part D?

If you’re on Medicare, you’re likely enrolled in Part D. In 2024, you pay 25% of drug costs after you hit $5,030 in total drug spending. You stay in this gap until you hit $8,000. Then catastrophic coverage kicks in.

But here’s the big change: Starting in 2025, the donut hole is gone. You’ll pay 25% of costs all year, with no gap. Also, insulin will cost no more than $35 per month. That’s huge.

Still, ask: “What’s my plan’s out-of-pocket maximum for 2025?” and “Does it include my copays and coinsurance?” Some plans don’t count all payments toward the cap. Make sure you’re tracking your total drug spending.

What’s the Annual Out-of-Pocket Maximum?

This is the most you’ll pay for covered drugs in a year. After that, the plan pays 100%. In 2025, Medicare Part D will cap this at $2,000. For private plans, it varies.

Compare plans using this number. A Bronze plan might have a $9,450 out-of-pocket maximum. A Platinum plan might be $3,050. If you’re on three or more medications, that $6,000 difference could save you thousands.

Ask: “Is the out-of-pocket maximum for drugs only, or does it include medical costs too?” Some plans combine both. Others separate them. Know which one you’re dealing with.

Are There Lower-Cost Alternatives?

Insurance plans often encourage cheaper alternatives. Sometimes that’s a generic. Sometimes it’s a different brand with the same active ingredient.

Ask: “Is there a generic version?” “Is there a different brand on a lower tier?” “Can I switch to a similar drug that’s covered?”

For example, if your plan doesn’t cover Eliquis but covers Xarelto, and your doctor says both work for you, switching could save $200 a month. Don’t be afraid to ask your doctor if alternatives are safe for you. Most are open to it-especially if you’re facing a $1,000 copay.

When Can I Change My Plan?

Most people think once you enroll, you’re stuck. Not true.

For Marketplace plans: You can change during Open Enrollment (November 1 to January 15). You can also switch if you have a qualifying life event-like losing job-based coverage, moving, or having a baby.

For Medicare: You can switch Part D plans during the Annual Election Period (October 15 to December 7). You can also change during the Medicare Advantage Open Enrollment Period (January 1 to March 31).

Ask: “When’s the next time I can switch plans?” And: “Can I change if my meds are dropped from the formulary?” Most plans allow you to switch mid-year if your drug is removed. But you have to request it. Don’t wait until you’re out of pills.

How to Check Coverage Before You Enroll

Use the tools that are already there. Don’t guess.

- For Marketplace plans: Go to HealthCare.gov. Use the plan comparison tool. Enter your medications (up to 15) and your preferred pharmacy. It shows you exact copays and whether prior auth is needed.

- For Medicare: Use Medicare.gov’s Plan Finder. Enter your drugs by NDC code (you can find this on your prescription label). It compares all Part D plans in your area.

- Call your insurer. Ask for the formulary. Request it in writing. Email it to yourself.

People who spend 20 minutes checking their meds before enrolling save an average of $1,147 a year. That’s more than the cost of a monthly premium difference. It’s not extra work. It’s essential.

What Happens If My Drug Gets Removed?

Plans can change their formularies during the year. If your drug is removed, you might get a notice. But sometimes you won’t find out until you’re at the pharmacy counter.

Know your rights: If your drug is dropped, you can request a temporary exception (usually 90 days) while you switch to a covered alternative. You can also appeal the decision. Many appeals are approved, especially if your doctor says the alternative won’t work.

Keep a copy of your formulary. Check it every fall before Open Enrollment. Don’t assume it’s the same as last year.

Final Tip: Track Your Spending

Keep a log of every prescription you fill. Note the copay, the date, and the total cost. At the end of the year, add it up. Compare it to your plan’s out-of-pocket maximum.

If you’re close to hitting it, you might qualify for a special enrollment period. Or you might realize you should switch plans next year. Either way, you’re in control.

Prescription coverage isn’t about what’s on paper. It’s about what’s in your wallet. Ask the right questions. Use the tools. Don’t wait until you’re out of pills to find out your insurance doesn’t cover them.

What if my prescription isn’t covered at all?

If your drug isn’t on the formulary, you can ask for a formulary exception. Your doctor must submit a letter explaining why you need it-usually because alternatives didn’t work or caused side effects. Many requests are approved, especially for chronic conditions. You can also switch plans during the next enrollment period.

Can I use a mail-order pharmacy to save money?

Yes. Many plans offer discounts for 90-day supplies through mail-order pharmacies. For maintenance drugs like blood pressure or diabetes meds, you can often save 20-40% compared to retail. Check if your plan includes mail-order and if your drug is eligible.

Do all insurance plans cover the same drugs?

No. Each plan builds its own formulary. Two Silver plans from the same insurer can have completely different drug lists. Always compare formularies side by side. Never assume coverage based on plan type or brand.

Why do some drugs have higher copays even if they’re the same strength?

It’s often about the manufacturer or formulation. Generic versions are cheaper. Extended-release versions cost more. Even if two pills have the same active ingredient, if one is branded and the other is generic, the brand will be on a higher tier. Always check the exact name on your prescription.

Is there help if I can’t afford my copay?

Yes. Many drug manufacturers offer patient assistance programs. Nonprofits like NeedyMeds and the Patient Access Network Foundation help with copays. Medicare Part D also has a Low-Income Subsidy (LIS) that can reduce your costs to near zero if you qualify. Check eligibility on Medicare.gov or ask your pharmacist.